The Comprehensive Guide to Cost Allocation in Accounting

In that case, it may choose to discontinue the higher-cost product or find ways to reduce the cost of production. Similarly, government regulations and taxes can also impact the allocation of resources by affecting the incentives for businesses and individuals to allocate their resources in a particular way. For example, suppose the Virginia Chicken Company can sell chicken parts such as feet, beaks and gizzards for five cents per pound at the split-off point. Since these parts ofthe chicken have relatively little value, they tend to fall into the category of by-products.

Get Any Financial Question Answered

As a result, they may face difficulties in determining the correct basis for allocation, which can lead to poor decision-making or compliance issues. A crucial principle in cost allocation is ensuring that costs are distributed based on the cause-and-effect relationship between the resource and the cost object. Time-Driven Activity-Based Costing (TDABC) simplifies the traditional Activity Based Costing approach by using time as the primary cost driver. Rather than allocating costs based on multiple cost drivers, TDABC assigns costs based on the estimated time it takes to perform specific activities.

Relationship Between Actual Costs & FP&A in Manufacturing

Without proper cost allocation, these reports could be misleading, making it difficult for stakeholders to make informed decisions. The direct allocation of costs clearly identifies which specific objects are incurring the costs. This transparency can help in decision-making, as it allows for a better understanding of the cost structure and facilitates the identification of cost-saving opportunities. The calculation of a product’s cost involves threecomponents—direct materials, direct labor, and manufacturingoverhead.

Is there any other context you can provide?

- The guiding principles of cost allocation are causality, benefits received, fairness, and ability to bear.

- For example, the inclusion of fixed costs, which are incurred regardless of the level of output, may not be helpful in short-term pricing decisions.

- Understanding real-world applications of cost allocation is crucial to appreciating its importance in business decision-making.

- To illustrate the advantages of the dual rate or flexible budget method, consider the revised information that appears in Exhibit 6-9.

- In finance and economics, “allocation” refers to distributing resources, such as money, to different projects or initiatives based on their perceived importance and likelihood of success.

- The step-down method is useful in situations where there are multiple service departments and some serve others more than they are served.

There’s also a simple way called the direct materials cost method that uses an allocation base of the same value as the variable rate. Using FAC or Variable costing can provide more accurate reporting on your company’s financials. Sequential allocation refers to allocating costs based on the sequence in which they are incurred.

Activity based rates would be needed to provide accurate product costs since direct labor is not used in proportion to machine hours.d. The purposes of cost allocations are closely related to the purposes of information systems outlined in Chapter 2 (See Exhibit 2-4 for a review). Cost allocations are needed to value inventory for external reporting purposes, for planning and monitoring thecost of activities and processes, and for various short term and long term strategic decisions. In addition,since cost allocation methods are components of the overall performance evaluation system, cost allocations tend to influence the behavior of theparticipants within the system. Therefore, system designers must also carefully consider the motivational, or behavioral aspects of alternative cost allocationmethods.

Cost allocation is a technique for allocating overhead costs across product lines based on their relative importance to the company’s overall performance. This way, retailers can determine which products contribute most (or least) to their bottom line and make decisions accordingly. Energy companies have long been able to allocate costs to different projects and branches, but they often face challenges when assigning overhead expenses. That’s because overhead costs are shared among the company’s functions, making them difficult to track. Finally, the company might allocate indirect costs based on the number of products produced in each department.

Here, larger or more profitable departments may shoulder a larger share of the costs. However, it is important that the application of this principle does not stifle the growth potential of smaller or less profitable units. In conclusion, while cost allocation is not without its challenges and criticisms, these can be managed and mitigated through thoughtful and informed management practices. Regular reviews and audits, coupled with the use of technological tools for data collection and analysis, can further enhance the accuracy and relevance of cost allocation in an organization. To address this challenge, organizations can develop robust estimation methods and validate their cost estimates periodically.

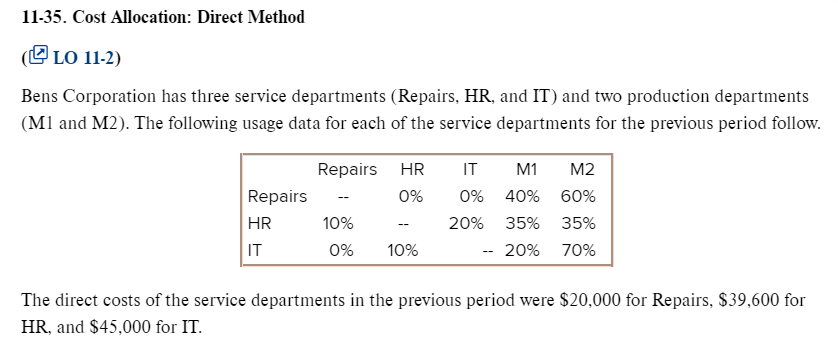

Forexample, if Service Department A uses some of Service DepartmentB’s services, these services would be ignored in the costallocation process. Because these services are not allocated toother service departments, some accountantsbelieve the direct method is not accurate. In allocating indirect costs to products, when will a plant wide overhead rate provide accurate product costs?

Another important aspect is the differentiation between product and period costs. Product costs are directly tied to the creation of goods or services and include expenses like raw materials, labor, and manufacturing overhead. These costs are capitalized as inventory on the balance management accounting and functions sheet until the product is sold. Period costs, however, are expensed in the period they are incurred and include selling, general, and administrative expenses. Understanding this distinction aids in accurate financial reporting and compliance with accounting standards.

These systems can handle complex calculations, track resource usage in real-time, and generate detailed reports, significantly reducing the administrative burden on financial managers. For instance, an ERP system can automatically allocate utility costs based on real-time energy consumption data from smart meters, ensuring precise and timely cost distribution. For example, let’s consider a factory with a production department and a maintenance department. With the direct allocation method, the costs of the maintenance department would be directly allocated to the products, not considering the services it provides to the production department. This simplification might be acceptable for some analyses, but it may not accurately represent the actual costs of producing each product, as it neglects the interdepartmental interactions and services. The direct method is generally more efficient compared to other complex cost allocation methods.

When allocating overhead costs, it’s important to choose drivers that reflect the relationship between the cost and the benefit received. For example, IT costs might be allocated based on the number of users supported, while administrative costs might be allocated based on the number of employees in each department. TDABC simplifies this by allocating costs based on the estimated time healthcare professionals and equipment are utilized for each service. These principles aim to allocate costs in a way that reflects the operational realities of an organization while promoting fairness and operational efficiency.

Вы должны быть авторизованы, чтобы оставить комментарий.

Об авторе