Nonprofit accounting: Beginner guide + key financial statements

These software solutions help automate and streamline the accounting process while ensuring compliance with relevant laws and regulations. Some popular nonprofit accounting software options include Aplos, QuickBooks Nonprofit Edition, and NetSuite’s Nonprofit Financial Management Solution. In conclusion, nonprofit accounting encompasses unique principles and practices essential to manage the financial resources of an organization. Understanding these fundamentals is vital to maintaining transparency, accountability, and trust among the stakeholders they serve. Now that your new nonprofit is up and running, developing a solid foundation for financial management should be a top priority. The ins and outs of nonprofit accounting may seem overwhelming at first, but effectively recording and reporting your Bookstime organization’s finances is essential to fund your mission.

Resources

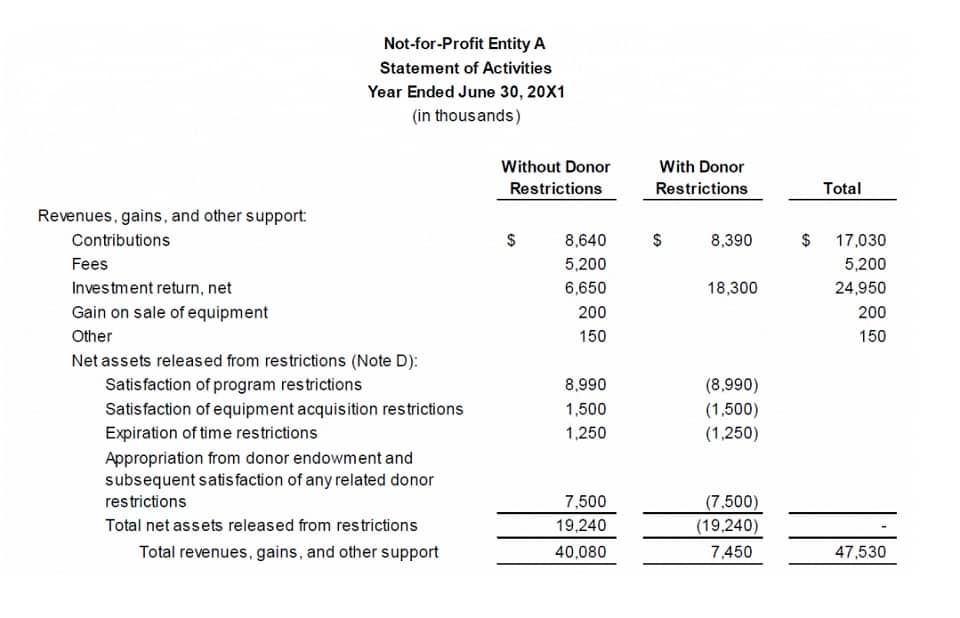

A statement of functional expenses in nonprofit accounting is a financial statement that shows an itemized list of expenses according to their purpose. It provides detailed information on where resources have been allocated within the organization. The primary focus of nonprofit accounting are accountability to stakeholders and donors rather than generating profits. Nonprofit organizations follow the same fundamental accounting principles as for-profit organizations but with a few key differences.

Use An Expense Management Software like Fyle

But the jargon surrounding nonprofit accounting can sound foreign, especially if you’re coming from a for-profit business. Here are some frequently-used phrases we use to accounting services for nonprofit organizations describe some of the elements of nonprofit accounting – and information on how to create and maintain a nonprofit budget. Outsourcing allows nonprofits to scale financial management services according to their needs. As the organization grows or experiences fluctuations in demand, the outsourced provider can adapt and provide the necessary support. Nonprofits that receive grants must fulfill reporting obligations outlined by grantors. Accurate and timely reporting ensures transparency and accountability to funders, enabling continued support.

What accounting method do most nonprofits use?

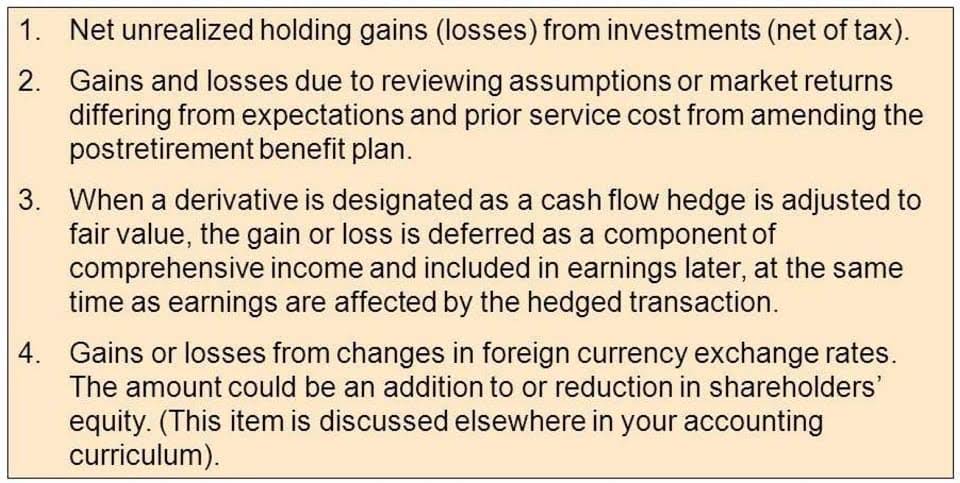

Complying with the generally accepted accounting principles (GAAP) will ensure that your nonprofit reports financial information accurately, transparently, and consistently. The cash-basis method is usually simpler to maintain than the accrual-basis method and may be adequate for smaller nonprofits. However, the accrual-basis method may be necessary if the organization plans to seek funding from larger donors.

What Type Of Accounting Do Nonprofits Use?

- This nonprofit accounting guide is great for anyone wanting to learn the foundation of nonprofit accounting.

- This nonprofit accounting statement breaks down the operating, financing, and investing activities to show how cash moves at the organization.

- Staying informed about budget planning and frequently asked questions regarding nonprofit accounting can help an organization successfully navigate the complexities of their financial management.

- It provides insights into the organization’s ability to generate money from its operations and how it manages its cash resources.

- In contrast, the accrual basis of accounting recognizes income when it is earned and expenses when they are incurred, regardless of when cash transactions occur.

- Form 990 is the annual tax form that tax-exempt (e.g. 501(c)3) organizations are required to file each year to remain compliant with the regulations and requirements set by the IRS.

If an organization’s gross receipts are usually $50,000 or less, it can submit Form 990-N, a simpler “e-postcard” version, instead of Form 990 or 990-EZ. Organizations with gross receipts under $200,000 and total assets under $500,000 at the end of the tax year can opt to file Form 990-EZ, a shorter form. Yes, the entire completed Form 990, excluding certain contributor information on Schedule B, must be made available to the public. This is a requirement both from the IRS and potentially from state governments to satisfy state-specific reporting obligations. Nonprofits must abide by the laws concerning taxes, filing deadlines, and any other applicable regulations that pertain to their special tax status.

- However, that paperwork, number crunching, and other tedious tasks come with the territory of running an effective nonprofit organization.

- Plus, nonprofits that regularly audit themselves will be considered more credible and trustworthy by potential donors.

- Just because your nonprofit qualifies as tax-exempt under Section 501 doesn’t mean that all of your donors’ contributions qualify as charitable deductions.

- But the jargon surrounding nonprofit accounting can sound foreign, especially if you’re coming from a for-profit business.

- DonorPerfect’s fundraising reports can be used to comply with state-specific fundraising disclosures.

Setting up a nonprofit budget requires a clear understanding of your organization’s financial situation, goals, and mission. It involves collaboration across departments to forecast both revenue and expenses for the upcoming fiscal year. Start by accounting reviewing your past financial performance, consider any upcoming projects or goals that will require funding, and estimate your income and expenditures accordingly.

Вы должны быть авторизованы, чтобы оставить комментарий.

Об авторе